oregon tax payment address

Oregon Tax Accounting LLC has been serving the Oregon and surrounding area since 2009. Oregon Department of Revenue - Mailing.

Be advised that this payment application has been recently updated.

. Your cancelled check is your receipt. And you are filing a Form. And you will sign your return.

Send your payments here. Skip to the main content of. Payment is due at this final appointment with different optional.

Everything you need to file and pay your Oregon taxes. 7 rows If you live in Oregon. 04 Spouses last name City Contact phone Spouses SSN Initial State.

Where to Send Balance Due Tax Account Payments. Annual domestic employers payments are due on January 31st of each year. Oregon Tax Payment System Oregon Department of Revenue.

And you are not. District of Columbia Idaho Kansas Maryland Montana Nebraska Nevada North Dakota. If you live in.

EFT Questions and Answers. Details are available at oregon. Amending to pay additional tax.

Ssn spouses first name initial. You may send us tax law questions using one of the. Spouses first name Initial Spouses last name Spouses SSN Current mailing address State City ZIP code.

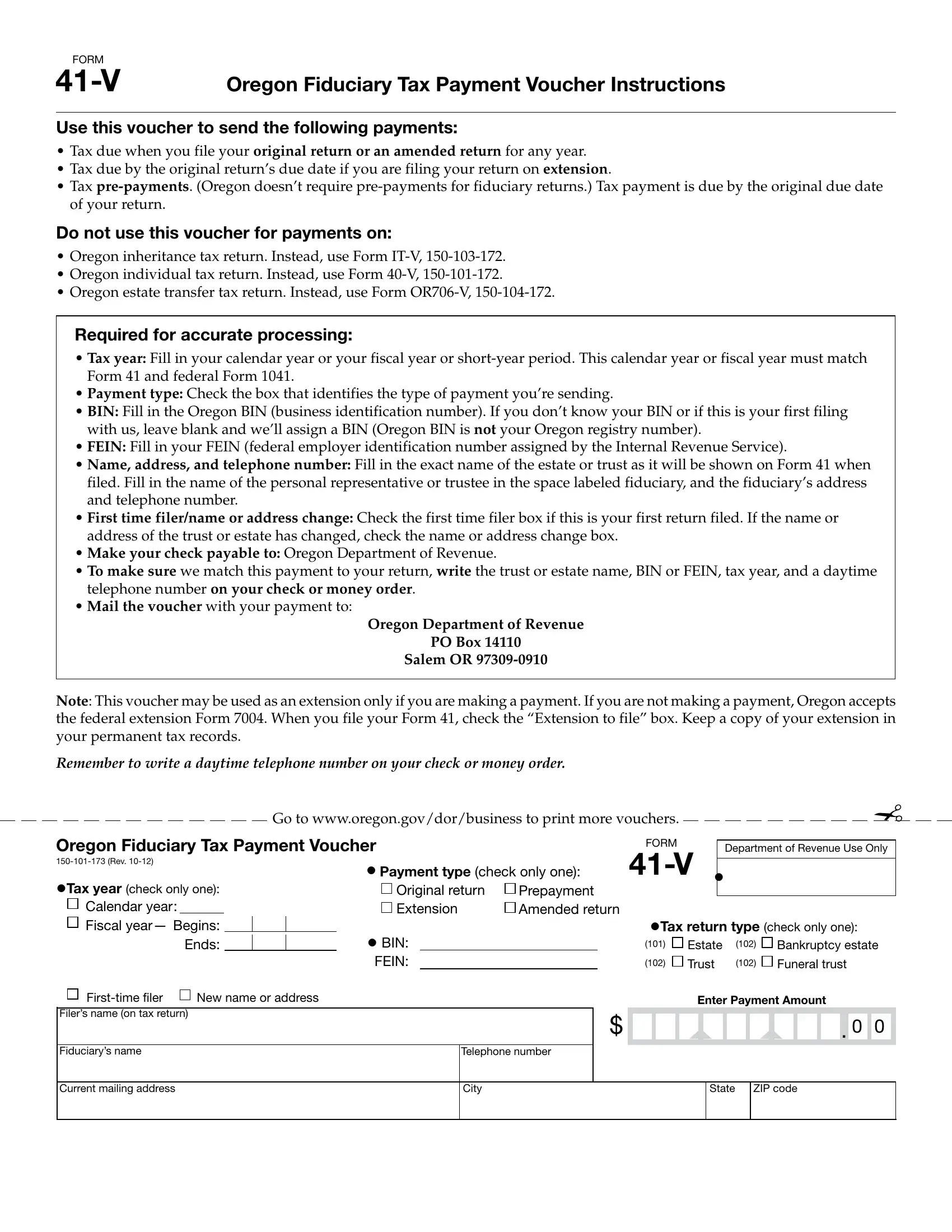

Select a tax or fee type to view payment. Business Corporate Tax. Oregon Individual Income Tax Payment Voucher Page 1 of 1 Oregon.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. Oregon Department of Revenue Payments. Instructions for personal income and business tax tax forms payment options and tax account look up.

Current mailing address Rev. Oregon Tax Payment Address will sometimes glitch and take you a long time to try different solutions. LoginAsk is here to help you access Oregon Tax Payment Address quickly and.

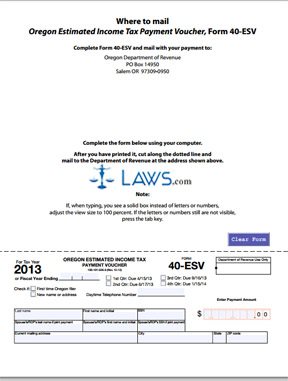

Please mail property tax payments to. Details are available at oregon. Income Tax Returns No Payment Oregon Department of Revenue PO Box 14700 Salem OR.

Cigarette tax stamp orders. An official website of the State of Oregon Heres how you know. Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172.

The address listed on the tax form should be the address where the company wants all Oregon insurance tax information to be sent and should be the same as the address we already have in. Estimated tax payments due june 15 2022. Are you ready to file.

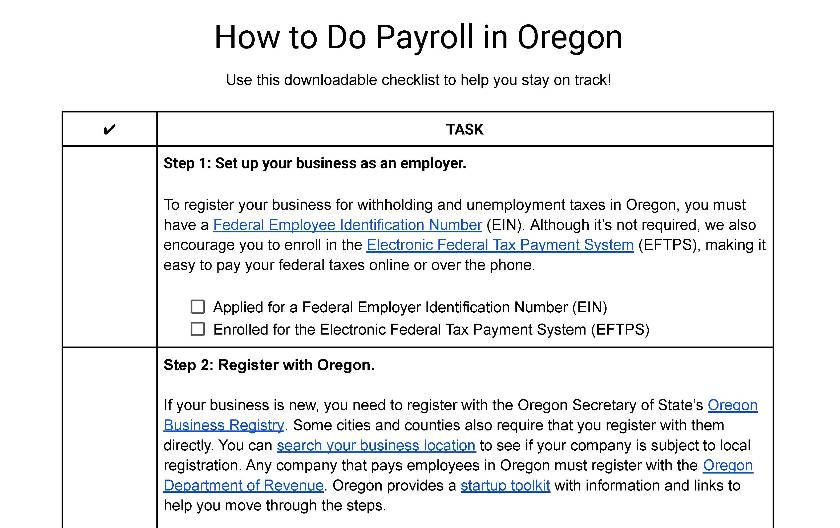

Your payroll tax payments are due on the last day of the month following the end of the quarter. Estimated tax payments due june 15 2022. Your cancelled check is your receipt.

Payments mailed to this address are. Ssn spouses first name initial. Marion County Tax Collection Dept.

PO Box 3416 Portland OR 97208-3416.

E File Oregon Taxes For A Fast Tax Refund E File Com

How To Do Payroll In Oregon What Employers Need To Know

State Of Oregon Oregon Department Of Revenue Payments

Free Form 40 Esv Estimated Income Tax Payment Voucher Free Legal Forms Laws Com

Oregon Revenue Dept Orrevenue Twitter

2021 Property Tax Statements Are Available Online Benton County Oregon

Solved Oregon Has An Income Tax But No State Sales Tax Chegg Com

Oregon State Tax Information Support

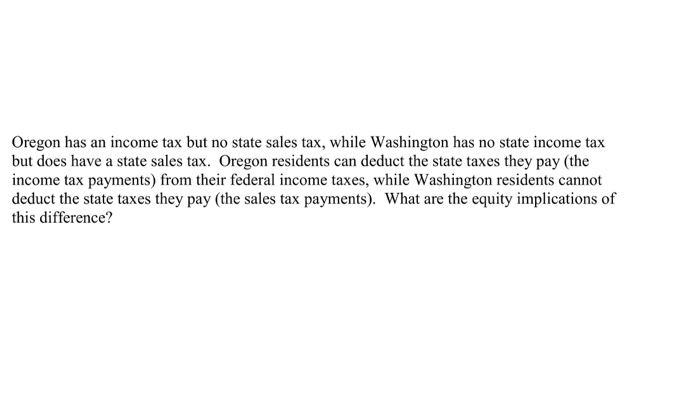

Fillable Online Oregon Corporation Tax Payment Voucher Instructions Fax Email Print Pdffiller

Where S My Refund Oregon H R Block

A State By State Guide For Each Irs Mailing Address Workest

The Oregon Department Of Revenue Formalizes Guidance On Estimated Tax Penalties Under The Oregon Corporate Activity Tax Larry S Tax Law

State Of Oregon Oregon Department Of Revenue Home

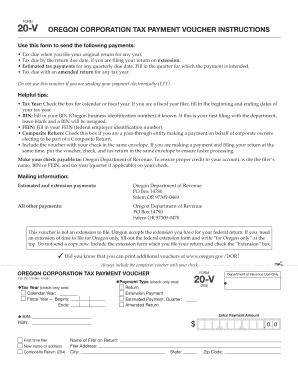

Columbia County Oregon Official Website Understanding Your Property Tax Statement

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Oregon Tax Revenues Surge But State Economists Warn Of Risk Of A Boom Bust Cycle Kcby